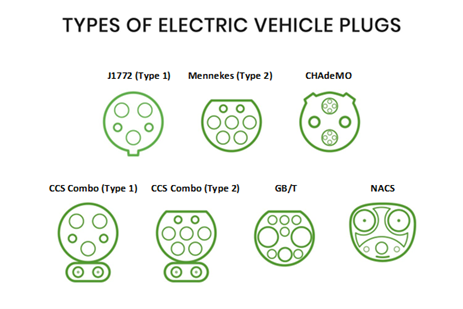

The electric vehicle (EV) industry is characterized by an abundance of charging connector standards including J1772, CCS1, CCS2, CHAdeMO, Mennekes, GB/T, and NACS. However, recent agreements between Tesla, Fisker, Ford, GM, Hyundai, Lucid, Mercedes-Benz, Nissan, Polestar, Rivian, Volvo, and SAE have reignited the debate on adopting a single standard. These brands will rely on the Tesla-developed NACS for both AC and DC charging in North America.

It’s worth noting that the current charging landscape in the USA EV public charging network consists of approximately 53,000 stations and 140,000 connectors. Additionally, the satisfaction from users is dropping according to JD Power. ChargePoint has around 18,000 stations in the USA, followed by Electrify America with roughly 5,000 stations, Blink with around 4,000 stations, and EVgo with 850 stations. Tesla operates about 1,800 stations with 17,000 connectors. Additionally, there are approximately 9,000 stations shared among hotels and franchises like Starbucks, Dunkin’, and McDonald’s. These stations often support multiple standards such as J1772, CCS1, even sometimes CHAdeMO. It requires users to have adapters and subscriptions to different networks for recharging. This adds to the challenge in terms of finding available and working charging spots while the number of stations increases at a slower pace than the number of BEVs sold each year.

(Source: Ducker Carlisle, svetolk/iStock/Getty Images Plus)

Tesla’s Game-Changing Influence on American Standards

The Biden administration has committed to investing $7.5 billion in charging infrastructure by 2030, aiming to deploy 500,000 connectors across the American road network. It’s crucial to recognize that charging time is one of the main barriers to the widespread adoption of Battery Electric Vehicles (BEVs). Consequently, it leads to range anxiety and creates a focus on charging and increased range (therefore, the weight and the cost of BEVs). Most automakers are joining Tesla and Volkswagen (through Electrify America) in the race to establish a denser charging network. In June this year, BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis have created a joint venture to launch a new public charging network in North America. This is essential as several independent networks face criticism regarding their speed, operational status, and compatibility.

Among existing charging networks, Tesla has managed to develop a more reliable solution, and the most satisfying to users, attracting the attention of GM and Ford in the first place. These two automakers were also first to announce their intention to adopt the NACS by 2025. It follows Tesla’s decision to open its network to its competitors. Fisker, Lucid, Mercedes-Benz, Nissan, Polestar, Rivian, Volvo also announced that they will adopt the NACS standard. But it doesn’t mean the market will abandon the widely used J1772 and CCS standards in the long term. First, the current plug-in EVs in operation are not all based on NACS. And second, to make NACS a long-term standard for North America would require the adherence of all OEMs.

Tesla’s Network and the Role of the US Government

In the electrification realm, strength lies in numbers and funding. Tesla requires the support of its competitors through opening its network to other brands to access a portion of the $7.5 billion investment from the US administration. In that battle for funding, the adoption of NACS as the main standard for most OEMs is a key victory for Tesla. It means Tesla’s network will be more easily opened to owners of other BEV brands. It is essential as taxpayer money must not be disproportionately allocated in favor of one brand over another.

As a result, Tesla opened its supercharger network to other brands. However, it’s limited to those with Magic Dock (as of now) and to V1 versions. Payments are processed through the Tesla app. This facilitates opening the Tesla network as its connectors don’t provide an interface for payment. In the meantime, it’s very unlikely that OEMs will provide Tesla with some access to their vehicles to trace and invoice customers accordingly. The limitation to certain Tesla superchargers also prevents from overcrowding as waiting times at strategic locations are long and the number of connectors can be insufficient.

A Global Standard for Connectors

The electrification of vehicles necessitates significant progress in addressing four main challenges simultaneously being technology, materials (quantity and cost), infrastructure, and energy. Technology remains the primary challenge. Innovative solutions are necessary to mitigate cost increases compared to ICE vehicles. Chemistries such as lithium iron phosphate (LFP) could alleviate some of these challenges, but they come with a significant drawback in terms of range. Toyota’s recent announcement of new battery generations capable of achieving ranges of 745 miles by the end of the decade, and later up to 900 miles, has generated anticipation in the industry (source: https://www.autonews.com/mobility-report/toyota-future-ev-plans-include-batteries-900-mile-range). However, the realization of such technologies at the prototype stage for potential industrialization remains at an early stage in engineering and we are years away from industrial production. Cost and availability issues will remain on both material and energy perspectives. Technology will ease the pain on materials while utility companies work on solving the energy issues. In the meantime, BEV adoption relies strongly on the infrastructure. One connector standard could definitely help grow networks and compatibility, but consumers are still waiting for the hockey stick growth that’s expected in terms of number of charging stations. While it’s possible that Tesla’s North American Charging Standard (NACS) could gain prominence in North America, there remain diverse charging standards worldwide. In Europe, the CCS standard is utilized for rapid DC charging, mirroring North America’s approach. The European CCS system combines the Type 2 connector with two DC quick charge pins, reminiscent of North America’s J1772 connector. Conversely, China relies exclusively on the GB/T plug for its charging ports. Due to the extensive deployment of charging stations that have been made so far, it’s uncertain whether a unified charging standard can be achieved across major EV markets in the near future.

North America CCS Type 2 port on Mustang Mach-E (DC/AC merged)

Tesla NACS port on Tesla Model 3 (DC/AC merged)

Europe CCS Type 2 port on Tesla Model 3 (DC/AC merged)

China GB/T charging ports on Tesla Model 3 (left: AC; right: DC)

Ducker Carlisle’s decades of automotive consulting experience and comprehensive expertise in auto and light truck manufacturing, electrification, aftersales, and parts benchmarking help automotive clients secure an advantage in a shifting global market. Learn more here.

Article Prepared By:

Leonard Ling, Senior Analyst – Automotive Knowledge Manager

Bertrand Rakoto, Director – Global Automotive Practice Leader